Scoring scan results

Printed From: BullCharts Forum

Category: BullCharts

Forum Name: Tips and Tricks

Forum Discription: Tips on how to use BullCharts more effectively.

URL: http://www.bullcharts.com.au/forum/forum_posts.asp?TID=118

Printed Date: 19 May 2024 at 12:58pm

Software Version: Web Wiz Forums 9.69 - http://www.webwizforums.com

Topic: Scoring scan results

Posted By: Peter

Subject: Scoring scan results

Date Posted: 28 Jan 2005 at 10:17am

|

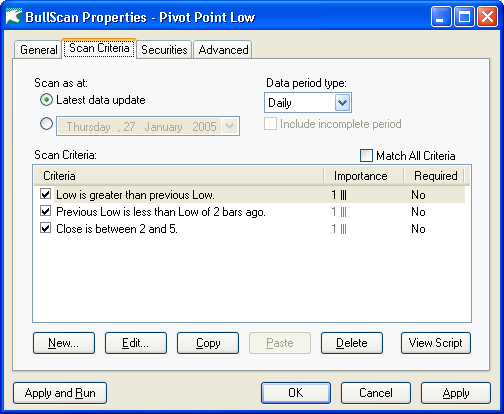

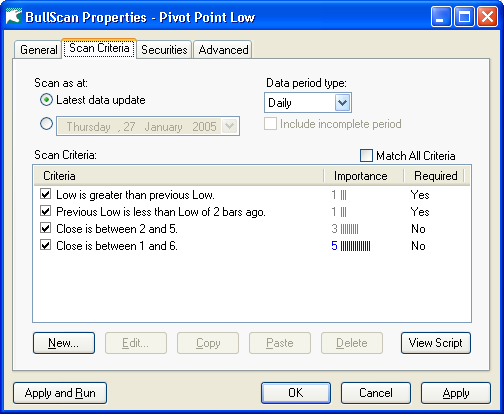

In BullScan, a security must normally fulfill every criteria in a scan

for it to be included in the results. But it is also possible to rank

securities based on how many criteria they fulfill. If you untick the "Match All Criteria" checkbox, found on the scan criteria tab of the scan properties, then a security needs to only meet one or more criteria to appear in the results. Each security will be assigned a score out of 100 based on how many criteria are matched. Eg. By default, if a security meets three out of four criteria then it will get a score of 75. By default, results are sorted by score.  Figure 1. Pivot point scan with match all unticked. This can be helpful, however there may be some criteria that you want to always find, and other criteria that are optional. When you untick "match all criteria" two new columns appear in the criteria list. (Shown in figure 1). The 'required' setting specifies that a particular column must be matched. This can be modified by right-clicking on the row and selecting required. In the pivot point example above, we may want to set the first two criteria as required - so that only pivot points are found, but the price range is optional. (With higher scores assigned to securities inside the price range, and lower scores to those outside the price range) The other column, importance sets the relative weight that the criteria has for scoring. (Note: If a column is marked as required then it does not participate in scoring.) So instead of marking columns as required, you could just set some as high importance and others as low importance. Using these ideas together, the pivot point example can be modified as shown below. Two price range criteria have been added. One for prices between $2 and $5. A second for prices between $1 and $6. If the price is between $2 and $5 then the security will get a high score. If it is just outside of that range then it will get a lower score, and it is outside the $1 and $6 range then it will still get shown, but with a much lower score.  Figure 2. Pivot point modified to rank prices. |