|

Smart Money |

Post Reply

|

Page 12> |

| Author | |

cmacdon

BullCharts Guru

Joined: 09 Sep 2012 Location: Brisbane Posts: 236 |

Post Options Post Options

Quote Quote  Reply Reply

Topic: Smart Money Topic: Smart MoneyPosted: 01 Oct 2012 at 9:28am |

|

Sorry here is correction to secon indicator value line above. I had a minus sign too many in first bracket Value1 := (((C--L)/(H-L))*Volume); {Buying Vol} Correction is Value1 := (((C-L)/(H-L))*Volume); {Buying Vol}

|

|

|

BC User since June 2007

|

|

|

|

joea

Newbie

Joined: 15 Nov 2011 Location: Miallo Posts: 19 |

Post Options Post Options

Quote Quote  Reply Reply

Posted: 30 Sep 2012 at 7:12pm Posted: 30 Sep 2012 at 7:12pm |

|

cmacdon

Thanks for that reply. I see it how you see it, but I did not purchase Tradeguider. I understand that Day from BullCharts did a bit on VSA but this does not work on my software. I have asked Brendon if they can add to BC, a couple of indicators and scans from VSA thinking. I would be happy with the sequence entry's and exits. In trading long. Now I must confess that I cannot code, so I really admire people who can, and especially those that share their efforts. (I can basic code, but not Bullscript like you or maximo). cheers joea |

|

|

|

cmacdon

BullCharts Guru

Joined: 09 Sep 2012 Location: Brisbane Posts: 236 |

Post Options Post Options

Quote Quote  Reply Reply

Posted: 30 Sep 2012 at 4:59pm Posted: 30 Sep 2012 at 4:59pm |

|

|

|

BC User since June 2007

|

|

|

|

cmacdon

BullCharts Guru

Joined: 09 Sep 2012 Location: Brisbane Posts: 236 |

Post Options Post Options

Quote Quote  Reply Reply

Posted: 30 Sep 2012 at 4:55pm Posted: 30 Sep 2012 at 4:55pm |

|

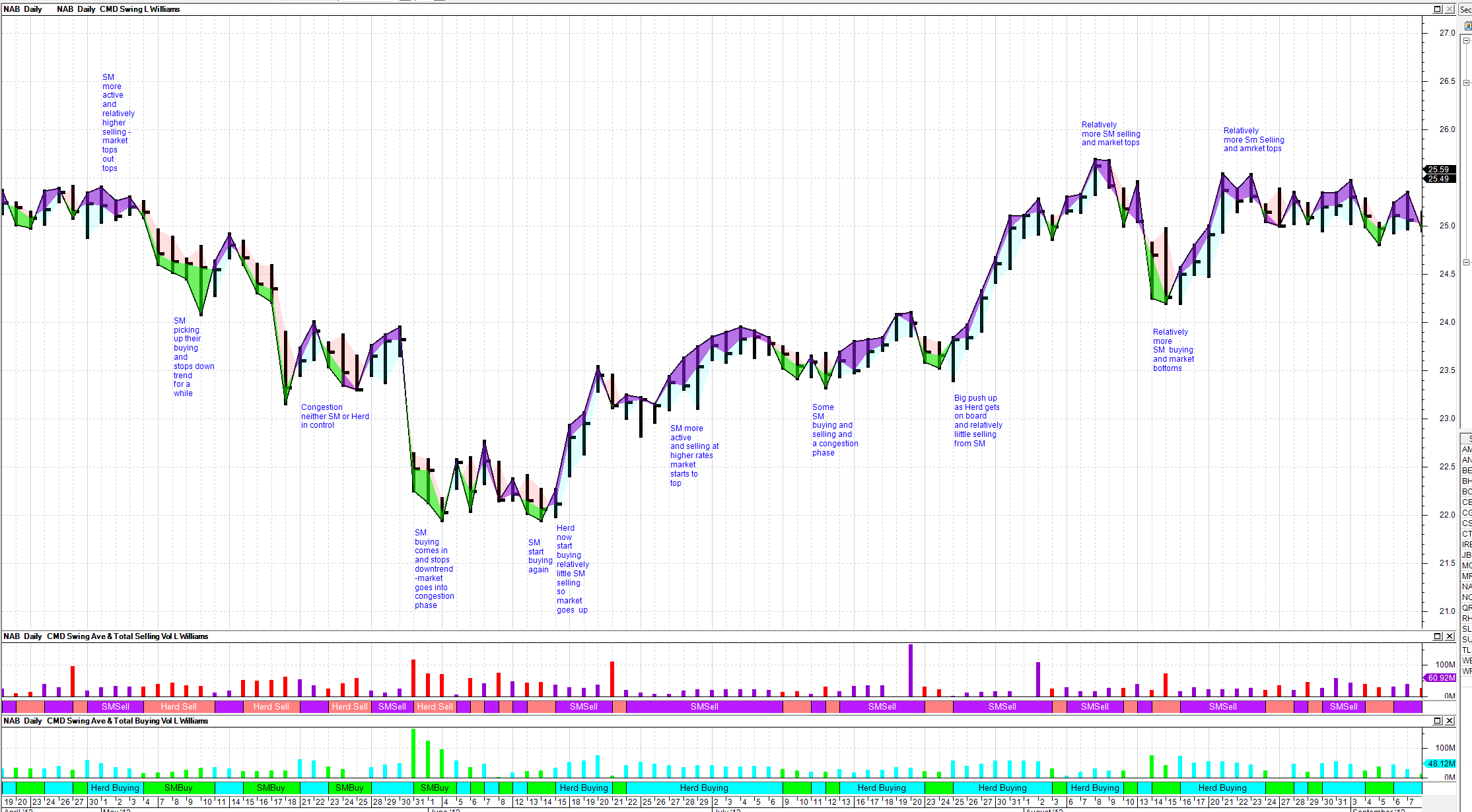

Joea I do not know if you have look at the videos from Garry Fullet who is a Wyckoff expert (I understand he recently left LTG-Trading where he posted some great Wyckhoff trading videos and has joined a new company but as yet I have not been able to track him down in the new company) but he used to say every chart had to tell him a story. Here is my "story" for interpreting the NAB chart shown above as a Tradeguider Screen and shown below as a bullcharts screen. I can get my mind around the latter but not the former. Hope this helps you understanding of where I am coming from when you compare the two pictures. |

|

|

BC User since June 2007

|

|

|

|

cmacdon

BullCharts Guru

Joined: 09 Sep 2012 Location: Brisbane Posts: 236 |

Post Options Post Options

Quote Quote  Reply Reply

Posted: 30 Sep 2012 at 12:51pm Posted: 30 Sep 2012 at 12:51pm |

|

Joea I will try to answer you posts in point form. 1 I am aware of Master the Markets. The book was provided to me when I bought

Tradeguider in 2008. I quoted the book in the Citation on the VSA template I

posted. I also trade the London market

at night using Tradeguider as Bullcharts cannot access E-signal data. 2. In a previous post I advised that VSA signals are very

judgemental, particularly if you try to write your own code after studying the

market in context. (BTW my reading of the MM book, p111 is that the 5 signs you

list you would be interested in if you were a Bullish Trader are listed in the

Book as being the main signs of weakness.

So you would be more interested in them if your were Bearish But see

point 5 below). 3. Tom Williams in his writings and also Gavin Holmes in his

videos state that VSA signals are not

buy and sell signals they are guides to help understand the context which is what I have said in my previous

posts. 4. Gavin Holmes developed the idea of VSA sequences in his

book Trading in the Shadow of the Smart Money.

I note the sequences you list in your post are from Gavins second book. Those sequences may work under certain market

conditions using the Tradeguider Software but in some contexts the sequence may

not work. 5. For instance , Gavin Holmes often points out that in down

trends discount the Signs of Strength signals and in uptrends discount Signs of

Weakness signals. Particular sequences from the books may be Ok if you are

using the Tradeguider software and their particular parameters but they are

probably irrelevant if you are writing your own code in Bullcharts, as you may

not replicate exactly the Tradeguider software, and you will want to research

and test your own sequences. 6. Which brings me to the issue I pointed out in the VSA

template post. The setting of the parameters

and in particular selecting a trending system is very important as some signals

which rely on whether the code interprets the bar as being in an uptrend or

down trend. In this regard it is of

little help to me, or even a Tradeguider user, to go to the Read the Ticker

site to see their trending system signals as neither Tradeguider or my

particular Bullcharts VSA temp[late uses the Read the Ticker trend system. (I have tested VSA on various trend

methodologies the H-iLo zig Zag used in the Wave Volume post, the Bullcharts

Trend System , Laguerre Cross overs, MA Cross overs etc). I have settled on a trending system that

gives me reasonably accurate turning points over 3 to 5 days because that suits

my style of trading. Other people may

differ and in Tradeguider you can identify many different trends by varying

their parameters as well. 7. In regard to the use of judgement , I would also refer

you to Sebastian Manby’s Advanced VSA training videos Course provided by

Tradeguider. Sebastian is a VSA expert

and was mentored by Tom Williams but he admits his interpretation of some VSA signals

differ from Tom Williams’s as he has refined his interpretation as he has

studied the market for himself, and sometimes he points out in his videos

incorrect signals shown in the

Tradeguider software. 8 In similar fashion the original Tom Williams Tradeguider

software signals and descriptions when released in the current version were

updated by Both Tom Williams and Phillip Friston another VSA expert, so they can

be updated and refined over time. 8. Getting back to identifying Smart money, here is a Tradeguider chart of NAB Bank with an uptrend and a down trend. The problem I have always had is looking at the chart how do I easily see if Smart Money is starting to get active or active. Hence my post as there is something you can do with VSA in Bullcharts that you cannot do in Tradeguider - or at least I can't.

|

|

|

BC User since June 2007

|

|

|

|

joea

Newbie

Joined: 15 Nov 2011 Location: Miallo Posts: 19 |

Post Options Post Options

Quote Quote  Reply Reply

Posted: 30 Sep 2012 at 10:14am Posted: 30 Sep 2012 at 10:14am |

|

Here is a indicator that shows the trend status.

http://www.readtheticker.com/Pages/Blog1.aspx?65tf=724_rtttrendstatus-continues-to-work-well-2012-09 joea |

|

|

|

joea

Newbie

Joined: 15 Nov 2011 Location: Miallo Posts: 19 |

Post Options Post Options

Quote Quote  Reply Reply

Posted: 30 Sep 2012 at 7:06am Posted: 30 Sep 2012 at 7:06am |

|

cmacdon

I thought I would explain myself a little better. In VSA software such as Tradeguider they are many SOW's and SOS's. However there are a small number of sequences for entry to long and short set-ups. Short set ups are as such. 1 SOW1 SOW104 SOW 199 2 SOW26 SOW7 SOW146 3 SOW90 SOW26 SOW198 4 SOW134 SOW10 SOW134 5 SOW5 (end of rising market) SOW2 (upthrust) SOW6 (no demand) etc. so it is not the sign of strength or weakness, but the sequence of of a combination of 3 SOS or SOW's that give the signal to alert. In the paperwork I have there are 10 short and 10 long entry set ups. no doubt there maybe the same number of exits from short and long trades. The sequence is the 'guts" of VSA. You must have the accurate volume, reflecting what the spread of the price bar is telling the trader. i.e volume spread analysis!!! I hope that explains it a little better. ..or my understanding of it. joea Edited by joea - 30 Sep 2012 at 9:19am |

|

|

|

joea

Newbie

Joined: 15 Nov 2011 Location: Miallo Posts: 19 |

Post Options Post Options

Quote Quote  Reply Reply

Posted: 29 Sep 2012 at 9:15pm Posted: 29 Sep 2012 at 9:15pm |

|

cmacdon

I may interpret things a little different to you. But basically my understanding is as follows. If you are a bullish trader there are 5 main signs. 1 The buying climax. 2 A failed test(a test that is not accompanied by low volume) 3 Narrow spread accompanied by high volume, on an up day, into new high ground. 4 The up thrust. 5 Sudden high volume on an up day(bar), with the next day (bar) down, on a wide spread, closing below the low of the previous bar. The herd actually buys from the smart money near the end of the rally. That is why it is called "smart money", because there would be no gain without buyers(the herd). joea. Edited by joea - 29 Sep 2012 at 9:16pm |

|

|

|

joea

Newbie

Joined: 15 Nov 2011 Location: Miallo Posts: 19 |

Post Options Post Options

Quote Quote  Reply Reply

Posted: 29 Sep 2012 at 9:02pm Posted: 29 Sep 2012 at 9:02pm |

|

cmacdon

I do not know if you are aware of the book, "Master the Markets". It can be down loaded free. Then there is Section 2 ... Trends and Volume Spread Analysis. Then there is the Trade Set up sequences. i.e. that is the complete list of SOW and SOS. This info came from Tradeguider. i.e. Short Trade Set Up. Sequence 1 SOW1 The buying climax(start of distribution) SOW104 Supply coming in(also has the appearance of an upthrust) SOW199 No demand(No demand at market top). Sequence 2 etc. joea |

|

|

|

cmacdon

BullCharts Guru

Joined: 09 Sep 2012 Location: Brisbane Posts: 236 |

Post Options Post Options

Quote Quote  Reply Reply

Posted: 29 Sep 2012 at 6:40pm Posted: 29 Sep 2012 at 6:40pm |

|

|

|

BC User since June 2007

|

|

|

|

Post Reply

|

Page 12> |

| Forum Jump | Forum Permissions  You cannot post new topics in this forum You cannot reply to topics in this forum You cannot delete your posts in this forum You cannot edit your posts in this forum You cannot create polls in this forum You cannot vote in polls in this forum |