|

Stepped price Indicator |

Post Reply

|

Page 12> |

| Author | |

cmacdon

BullCharts Guru

Joined: 09 Sep 2012 Location: Brisbane Posts: 236 |

Post Options Post Options

Quote Quote  Reply Reply

Topic: Stepped price Indicator Topic: Stepped price IndicatorPosted: 16 Dec 2012 at 3:47pm |

|

|

|

BC User since June 2007

|

|

|

|

cmacdon

BullCharts Guru

Joined: 09 Sep 2012 Location: Brisbane Posts: 236 |

Post Options Post Options

Quote Quote  Reply Reply

Posted: 16 Dec 2012 at 3:47pm Posted: 16 Dec 2012 at 3:47pm |

|

|

|

BC User since June 2007

|

|

|

|

cmacdon

BullCharts Guru

Joined: 09 Sep 2012 Location: Brisbane Posts: 236 |

Post Options Post Options

Quote Quote  Reply Reply

Posted: 16 Dec 2012 at 3:46pm Posted: 16 Dec 2012 at 3:46pm |

|

|

|

BC User since June 2007

|

|

|

|

cmacdon

BullCharts Guru

Joined: 09 Sep 2012 Location: Brisbane Posts: 236 |

Post Options Post Options

Quote Quote  Reply Reply

Posted: 16 Dec 2012 at 3:45pm Posted: 16 Dec 2012 at 3:45pm |

|

In response to a query by Charlie-B concerning the Joe Ross Concolidation I will post below perhaps a better way to monitor ranges and breakouts and how I use the adapted stepped price inidcator to scan for fast moving stocks on 5 to 15 minuute charts.

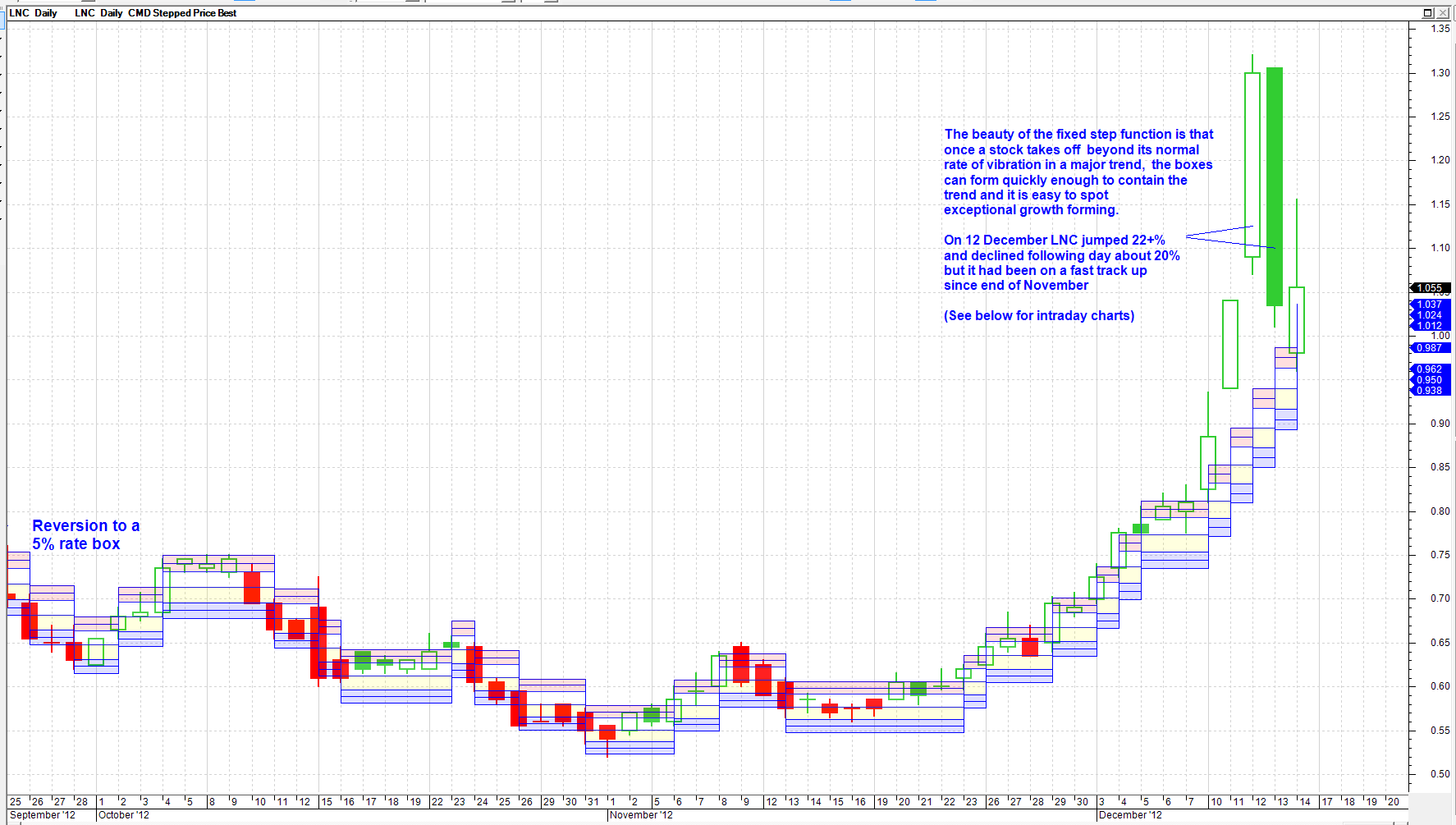

Chart 1 is the daily showing the stepped price indicator with my adapted code previously posted on LNC using 5% boxes. The chart shows trading ranges and colours the bars if they are above or below the mid range of a box. Breakouts are easily seen. Chart 2 shows that if an exception trend occurs the fixed % boxes cannot form quickly enough as they are restricted to say in this case 5% per change and a stock might be tearing away abnormally at a much higher rate e.g LNC over last few days. However they will usually revert to there mean vibration so you can anticipate a change of direction. I code my watchlists into 2% to 8% per day Stepped Price Vibrations and most ASX stocks fit into one of these watchlists very well. Chart 3. Is a 5 Minute chart. So if I want to look at stocks moving at a a rate higher than 2% per day I set the vibration factor at 2%/60 for 5 minute charts as there are a 6 hours perr trading day = 0.0333%. A 15 minute chart scan would be set at 0.8333%. On chart 3 you see side by side a ANZ stock chart moving slowly at less than 2% per day from top of box to mid point, and the normal looking adapted stepped indicator box as a trading range. On the other hand in the right hand box is LNC on similar 5 minute chart but the stepped function is a series of small boxes that cannot contain the price trend. So I can know very early in a 5 or 15 minute chart that a scanned chart is looking like having a very good fast trending day beyond my target rate as distinct from bneing in a more sluggish a ranging day. The other thing you can do with this restriction on the rate at which boxes can form is work out Gann Style squaring of time targets into the future. Or work out rates of growth like Gann angles and if a stock is moving correctly the stepped price lines will form as straight lines at an angle from any point where price and time have come together. |

|

|

BC User since June 2007

|

|

|

|

cmacdon

BullCharts Guru

Joined: 09 Sep 2012 Location: Brisbane Posts: 236 |

Post Options Post Options

Quote Quote  Reply Reply

Posted: 10 Sep 2012 at 9:23pm Posted: 10 Sep 2012 at 9:23pm |

|

Here is a variation that is reasonably good for identifying coloured up and down trends by varying the step function

[target=price; author=Cameron, Rod/BlackDog and

Maximo posts; category=zzz] expr:=

Expression("Expression",C); a:= input("Step

%", 3, 0, 100); b:= a/100; base:=

if(expr>=prev(expr)*(1+b), prev(expr)*(1+b), if(expr<=prev(expr)*(1-b), prev(expr)*(1-b), prev(expr))); [linestyle=dotted] base; upper:=

base*(1+b); upper; upper2:=

base*(1+(b/2)); upper2; Upper3:=

base*(1+(b*3/4)); Upper3; lower:=

base*(1-b); lower; lower2:=

base*(1-(b/2)); lower2; lower3:=

base*(1-(b*3/4)); lower3; [linestyle=fill; color=Red;] upper;

upper2; [color=White] upper2;

base; [color=Yellow] base;

lower2; [color=Blue] Lower2;

lower; [linestyle=pricecolor] [color=Lime Green] Close>base; [color=Red] Close<=base; [color=Blue] true; |

|

|

BC User since June 2007

|

|

|

|

RODCAM

Newbie

Joined: 15 Nov 2007 Location: Australia Posts: 14 |

Post Options Post Options

Quote Quote  Reply Reply

Posted: 03 Apr 2008 at 4:30pm Posted: 03 Apr 2008 at 4:30pm |

|

BD, Thanks, another small incremental change in coding (below) makes it easier to visually pick up break outs, by just delaying the channel one period. I've played around a bit and the indicator is useful for not just break outs but also when prices are range bound. Some interesting results even on a stand alone basis when backtested with Tradesim... [author =Cameron, Rod][target =price]expr:= Expression("Expression",C);a:= input("Step %", 21, 0, 100);b:= a/100; base:= if(hist(expr,1)>=prev(expr)*(1+b), prev(hist(expr,1))*(1+b), if(hist(expr,1)<=prev(expr)*(1-b), prev(hist(expr,1))*(1-b), prev(expr)));upper:= base*(1+b); midup:= base*(1+b*0.618); middn:= base*(1-b*0.618); lower:= base*(1-b); [linestyle =solid; color=blue][name =Upper]upper; [name =Base]base; [name =Lower]lower; [linestyle =dotted; color=red][name =Midup]midup; [name =Middn]middn; [linestyle =fill; color=green][name =Top Fill]upper; base; [color =red][name =Bot Fill]base; lower;

|

|

|

RODCAM - Brisbane

|

|

|

|

blackdog

Regular

Joined: 14 Nov 2006 Location: Vatican City State Posts: 43 |

Post Options Post Options

Quote Quote  Reply Reply

Posted: 03 Apr 2008 at 1:37pm Posted: 03 Apr 2008 at 1:37pm |

|

Rodcam,

It is very interesting to see the "minor differences" between your code and my code produce such large differenced in the graph. Your code limits the change to the step amount while in mine the step went to the new value of C when triggered.

I have been looking at it on CSL daily using 10% steps. Your code is much less succeptable to zigzagging than mine.

Very nicely done rodcam!

|

|

|

|

maximo

BullCharts Guru

Joined: 02 Sep 2006 Location: Australia Posts: 232 |

Post Options Post Options

Quote Quote  Reply Reply

Posted: 28 Mar 2008 at 11:33pm Posted: 28 Mar 2008 at 11:33pm |

|

Thanks blackdog always a help!

|

|

|

|

RODCAM

Newbie

Joined: 15 Nov 2007 Location: Australia Posts: 14 |

Post Options Post Options

Quote Quote  Reply Reply

Posted: 28 Mar 2008 at 6:11pm Posted: 28 Mar 2008 at 6:11pm |

|

Congratulations BD you get the cigar - at least on paper because after some other insights provided to me today I was able to code exactly what I was after before having read your post. (yeah..sure [target=price; author=Cameron, Rod; category=zzz] expr:= Expression("Expression",C);a:= input("Step %", 21, 0, 100);b:= a/100; base:= if(expr>=prev(expr)*(1+b), prev(expr)*(1+b), if(expr<=prev(expr)*(1-b), prev(expr)*(1-b), prev(expr)));base; upper:= base*(1+b); upper; lower:= base*(1-b); lower; [linestyle =fill; color=green]upper; base; [color =red]base; lower; I have not yet had a chance to check out the results of Maximo's coding but I will sometime over the weekend. As he correctly concluded my indicator is just another form or support & resistance, but I specifically wanted to use % since the fixed % steps allow you to visually roughly calculate profits or losses of price breakouts...everyone to their own! Thanks BD and Maximo.

|

|

|

RODCAM - Brisbane

|

|

|

|

blackdog

Regular

Joined: 14 Nov 2006 Location: Vatican City State Posts: 43 |

Post Options Post Options

Quote Quote  Reply Reply

Posted: 28 Mar 2008 at 11:50am Posted: 28 Mar 2008 at 11:50am |

|

Rodcam, I think the following code does what you want. [description ="plot the closing price in steps as it increases or decreases by a set input percentage, a bit like a Renko chart but shown as a line chart"][target =Price; author=zzz; category=zzz]steps := input("step percentage",10,0);blueline:= if (C*(1+steps/100)<=prev,C, if (C*(1-steps/100)>=prev, C,prev));[name ="blueline"; color=blue; width=2; linestyle=solid;]blueline; regards, BD

|

|

|

|

Post Reply

|

Page 12> |

| Forum Jump | Forum Permissions  You cannot post new topics in this forum You cannot reply to topics in this forum You cannot delete your posts in this forum You cannot edit your posts in this forum You cannot create polls in this forum You cannot vote in polls in this forum |